When it comes to predicting the future of real estate, no one knows for sure what will happen. Some “experts” are more convincing but if you look at the “experts” track record you’ll see they don’t know. No one can predict what the government will do and how it will impact real estate. When covid hit people were not predicting the government to lower rates and pump money into the economy, then shutting down most of the country while Florida stayed open. This caused a massive influx of people to move to Florida seeking more freedom, causing real estate prices in Cape Coral Florida to explode. I don’t think anyone could have predicted things to unfold the way they did but here we are.

Real estate trends, meaning, it takes time to adjust up or down, not like the stock market or cryptocurrency that can crash with huge daily swings. When a Seller list their Cape Coral home for sale. They have us come over, evaluate their home and determine what the listing price of their Cape Coral home should be. We follow try to follow how appraisers determine value, we rely heavily on similar type of home with similar features that recently sold and closed with in a close proximity. The issue with this data is it’s slightly old data. If a home sold, it likely took 60 days to close, so we are looking at events that took place maybe 60-90 days ago and recorded recently. It’s possible in the last 60-90 days the market went up or down. We follow recent news and events, is the news positive for real estate or negative. Whatever is going on real estate will likely trend towards.

Here’s some trending factors we look at:

- Is inventory going up or down

- Is Mortgage rates going up or down

- Original list price vs sold price

- Is the news positive or negative

- Inflation, are fixed costs rising?

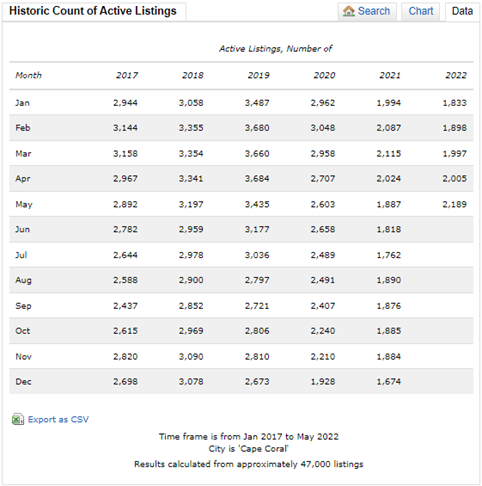

- Cape Coral housing Inventory 2022

Housing inventory is growing. We had 2,189 listed homes in Cape coral in May 2022 and the most in the last 5 years was in April 2019 3,684. The lowest was December 2021 1,674 listed homes. We need to watch this close and see if Cape Coral housing inventory continues to trend up, Buyers will have more options and prices will slow or possibly reverse.

2. Mortgage rates.

Here’s a graph from Freddie Mac showing 30 year mortgage rate was 2.77% on August 5th 2021. Rates on June 15th 2022 were 5.97% and moving up. That’s a huge swing from not even a year ago. A buyers payments have drastically increased causing some buyers to throw in the towel and wait. Some buyers have had to cancel their new construction build because they no longer qualify, simply cant afford the cost increase.

FreddieMac mortgage rate graph

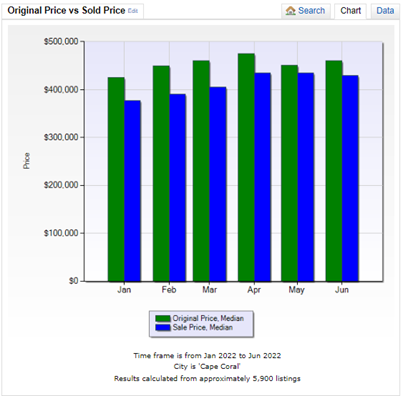

3. Original list price vs sold price

We are not seeing a huge discrepancy is original list price vs sold price. It was comparable in 2021. I’m seeing a lot of price reductions, we will see if the graph holds or if inventory and interest rates continue to rise we may see the gap grow between original list price vs sold price. We need more time to determine this.

4. Is real estate in the news positive or negative?

I’m seeing both. It seems to be a common theme real estate is slowing down and its too early to tell what’s going to happen. I’m aware of doom and gloom youtube podcasters, I take what they say with a grain of salt, they try to create catchy titles for clickbait to get subscribers and views. I regularly see titles like “Housing is crashing” and search their channel and they’ve been saying that for years. When I’m reading through the news I try to look at it, is it more negative, neutral or positive. When enough news starts to trend in one direction it does impact Sellers and Buyers. Look at all the positive news we’ve seen the last couple years and buyers went crazy “buy now before you can’t afford to” and buyers went super aggressive on offers to buy a home. Same is true if we see negative news buyers will start making lower offers and being more patient.

Here’s some recent headlines I’ve seen in the news:

Yahoo financial news where-housing-market-headed

Yahoo news housing could drop 15-20%

5. Inflation, are fixed costs rising?

We can see massive inflation, food, gas, vehicles, boats, houses, everything is highly inflated. In real estate a negative cost associated with rising real estate prices is property taxes go up and so does home insurance. If your home goes up in value it only benefits you if you move, if you stay it’s a negative effect, you have to pay more for the same service.

Florida-realtors-inflation-hurts-buyers

In Cape Coral flood insurance is expected to rise in costs.

Fox4now Flood insurance-likely-rising-for-most-Floridians

With the wreckless decision of government forcing businesses to shut down, lower rates for way to long, the Federal Reserve printed WAY too much money, we are seeing the result of poor government polices causing massive inflation, 40 year highs, food, gas, hotels, flights, vehicles, housings, pretty much everything is way inflated. To fight high inflation now the Federal Reserve must aggressively raise interest rates which usually spills over to mortgage rates. Mortgage rates jumping fast is resulting to a market shifting quickly. Imagine meeting a Cape coral home builder, agreeing to purchase a new construction home that will be built. The contract allows for price adjustments due to inflation cost changes. It takes about a year or longer to build a new home, in that time the price adjust up and interest rates double causing mortgage payment to rise drastically and now the buyer cant afford the home. This is happening in Cape Coral now.

Lastly, Moody’s – A company that provides investors with data rated the top 10 most overpriced housing markets, here’s how they rated Florida:

Homosassa Springs MSA (57%)

Palm Bay-Melbourne-Titusville MSA (48%)

Punta Gorda MSA (45%)

Vero Beach-Sebastian MSA (42%)

Port St. Lucie MSA (40%)

Crestview-Fort Walton Beach-Destin MSA (40%)

Cape Coral-Fort Myers MSA (39%)

Miami-Miami Beach-Kendall Metropolitan Division (39%)

Naples-Immokalee-Marco Island MSA (38%)

North Port-Sarasota-Bradenton MSA (38%)

Here’s a ling to Florida Realtors article Florida 10 most over valued markets

Cape Coral over valued 39%!!! Wowza!! Taking into consideration peoples incomes and construction prices, real estate is 39% over valued. This does not mean they will drop by 39%, it’s just one piece of data to look at and consider if prices will climb, go flat or decline. Prices may continue to rise if out of state buyers continue to move to Cape Coral but it appears this has slowed down and we are entering a more normal flow of buyers and sellers.

In conclusion, remember, real estate trends, it takes time, however, by most measures it appears it’s tending away from a dominate sellers market heading towards a more neutral market. We will continue to watch the changes and keep you informed. If you want a free market analysis, please reach out to us. Thanks for reading.

Troy Molde